Most of Cash Flow from Investing – See above outside of Capital Expenditures, most of the CFI section of the Cash Flow Statement represents non-recurring items that are related to optional “side activities” like buying and selling securities.Most Non-Cash Adjustments on the Cash Flow Statement – Many of the other items here, such as Gains and Losses, are non-recurring and have nothing to do with the company’s core-business operations.

FREE CASH FLOW FORMULA FROM EBITDA FREE

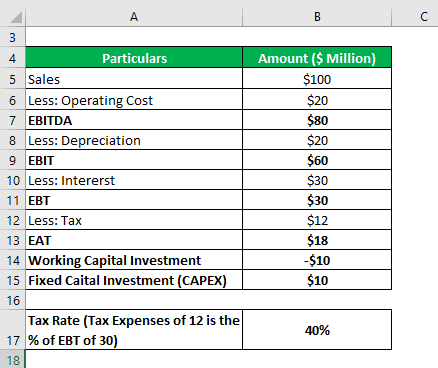

Unlevered Free Cash Flow = Operating Income * (1 – Tax Rate) + Depreciation & Amortization +/- Deferred Income Taxes +/- Change in Working Capital – Capital Expenditures Subtract Capital Expenditures (CapEx), which represents re-investment into the company’s business in the form of spending on long-term assets such as land, factories, buildings, and equipment.Add or subtract the Change in Working Capital, which indicates how the company is managing payments from customers, inventory, bills from suppliers, and other receivables and payables.

If the company has Deferred Income Taxes or other recurring items that affect its cash flow, also factor those in.Add back the company’s Depreciation & Amortization, which is a non-cash expense that reduces its taxes but which does not “cost” it anything in cash in the current period.Multiply by (1 – Tax Rate) to get the company’s Net Operating Profit After Taxes, or NOPAT.Start with Operating Income (EBIT) on the company’s Income Statement.You can see how everything ties together in the screenshot below for Steel Dynamics:Įach company is a bit different, but a “formula” for Unlevered Free Cash Flow would look like this: Then, we discount the UFCFs to their Present Value at the appropriate discount rate, estimate the company’s value from the end of the projection period into infinity (the “Terminal Value”), take the Present Value of the Terminal Value, and add these two components together to determine the company’s Implied Enterprise Value. We use Unlevered Free Cash Flow in a Discounted Cash Flow (DCF) Analysis to value a company, and we start by projecting the company’s Unlevered Free Cash Flow over 5, 10, or even 20 years. You can see how we calculate it in real life for Steel Dynamics (STLD) in a screenshot of our DCF model for the company below: That are recurring for the company’s core-business operations.Related to or “available” to all investors in the company – Debt, Equity, Preferred, and others (in other words, “Free Cash Flow to ALL Investors”) AND.Unlevered Free Cash Flow, also known as UFCF or Free Cash Flow to Firm (FCFF), is a measure of a company’s cash flow that includes only items that are:

0 kommentar(er)

0 kommentar(er)